Your home mortgage rates are one of the hottest issues on the market and it’s reasonable to wonder what the future will be like in 2025 because of this. That this data is necessary for homebuyers, homeowners and investors is clear. Here, I am going to disclose prognosis and estimation of mortgage rate predictions 2025, due to the current situation and projected forecasts.

Current Mortgage Rate Landscape

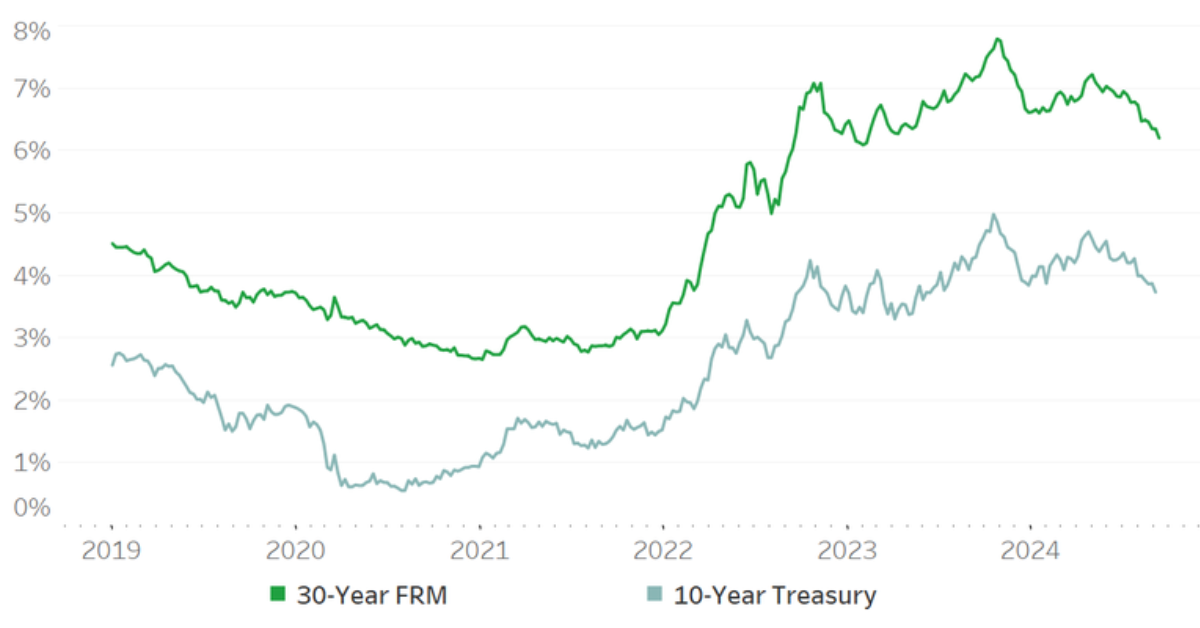

Let us first look at the present situation regarding mortgage rates before talking about 2025 predictions. 2024 witnessed a different trend in the market. Various interest rates were the main causes and effects of the market situation.

Factors Influencing Mortgage Rates

If we expect to know where the rates will be going in 2025, then we must include the main factors that influence them:

1. Economic Growth

The general well-being of the economy plays a major role in the calculation of mortgage rates. We might be forced to increase due to the economy prospects and inflation pressures.

2. Inflation

The change in the inflation rate may lead to mortgage rates’ direct variation. To maintain the market in balance, inflation has to be targeted properly to keep mortgage rates low.

3. Federal Reserve Policies

US Fed’s monetary policy correctness, especially types like the federal funds rate, can be a significant contributor to interest rate fluctuations and therefore be important to the housing sector.

4. Housing Market Conditions

The price and the request aspects of the real estate market affect loan interest rates indirectly.

Expert Predictions for 2025

Mortgage rates are among the most complicated financial problems to solve. However, it’s possible for me to make some educated guesses up this point. So here are the expert forecasts, irrespective of the difficulty in predicting the actual mortgage rates:

Gradual Increase

Regardless of the individual findings, most of the experts believe that loan rates may go up sometime or by 2025 that is based on the still growing tendency and possible inflationary pressures.

Potential Range

One way to look at it would be that 30-year fixed mortgage rates might be between 4.5% and 5.5%% by 2025. However, these are just approximations and the real circumstances might be different.

Factors That Could Affect Predictions

A lot of unforeseen events such as:

-

- Unexpected economic events

-

- Changes in government policies

-

- Global economic conditions

-

- Technological advancements in the lending industry

Impact on Homebuyers and Homeowners

Knowledge about the potential predicted mortgage rate trends can persuade the individual investor.

For Potential Homebuyers

If the rates increase as estimated, then you may want to practically plan buying a home soon rather than delaying. But, with the personal financial situation and the real estate market demand, this decision is also influenced.

For Current Homeowners

If people look at their current loans and the rates on them and find out that it’s the adjustable option, then they must refinance to the fixed rate mortgage way as per the future rate increase risks.

Strategies for Navigating Future Mortgage Rates

Why should I tell you if the rates will go over or below at the end of 2025? I have strategies for you that will get money secured with the best possible rates of all.

1. Improve Your Credit Score

Getting a good credit score is going to be your way of applying for better mortgage rates. Miss your bills rarely and reduce the total debt.

2. Save for a Larger Down Payment

A better down payment might mean less interest and the value of your mortgage may be cut down in general.

3. Shop Around

Although you received an offer at the beginning, don’t forget to look at offers from other companies so you can find the best.

4. Consider Different Loan Types

For example, look at the different types of mortgage loans available, such as conventional, FHA, and VA, and choose the one that is most suitable for you.

The Role of Technology in Future Mortgage Rates

It’s natural to expect that the technology’s rise will affect the mortgage market by 2025 to a great extent:

Digital Lending Platforms

The online-based mortgage lenders and digital platforms are predicted to continue growing which would mean a possibility of lower interest rates as a result of increased competition.

AI and Machine Learning

These technologies may help the loan approval procedures to become more accurate and personal, so the interest rates can be charged individually.

Preparing for 2025: What You Can Do Now

It is not possible to predict with full certainty whether or not a mortgage will rise in cost in the future but there are recommendations you can take into consideration.

1. Monitor Your Credit

Go to the credit information you get àn update on your line of credit and take reasonable steps to improve your credit.

2. Build Your Savings

At present, you are trying not to become financially unsecured by starting saving for the development of a safe future.

3. Stay Informed

Take your time for frequent checking of the news to see if there are any new economic events and real estate development trends in the market.

4. Consult with Professionals

Talking about a Financial Advisor or getting a mortgage professional’s advice to understand how your specific situation could be affected by possible rate hike could be useful.

Conclusion

Anticipation for the future and what it will bring is a natural human trait. To that end, we are forecasting the mortgage rates fluctuated, possibly on the rise, in light of the fact that there are so many factors that may change the situation. Through being acquainted with the situation, shaping your financial health, and affiliates who you trust will help you to be better ready for the upcoming mortgage landscape. Thus, you will be able to find the mortgage solution that corresponds to your conditions regardless of the mean values of the interest rates.

Leave a Comment