Understanding Car Finance: A Comprehensive Guide for Everyone

Car finance has caused so many problems and also miracles in the use of cars. When I was in the automotive industry for a few years, I had seen both the dark and the bright side of car finance. In this blog, I’m going to share my knowledge and experiences with you so that you can finance your car without worry.

What is Car Finance?

Car finance is the process of borrowing a car that can be paid for over a specified period with funds borrowed from a financial institution. It’s the method of car buying, most often used by people who don’t have enough money to buy a car all in one go.

Types of Car Finance

There are various options for car financing. In short, the following options are the most common:

-

- Personal Contract Purchase (PCP)

-

- Hire Purchase (HP)

-

- Personal Contract Hire (PCH)

-

- Personal Loan

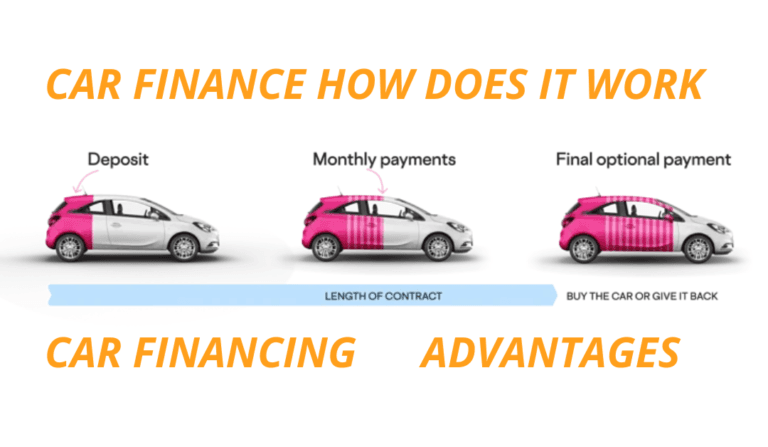

Personal Contract Purchase (PCP)

A PCP is the method of buying a car that many people pick. The PCP buyer deposits a certain amount or provides monthly payments and then, when it expires, the buyer must select one of the three options.

-

- Return the car

-

- Pay a final ‘balloon’ payment to keep the car

-

- Use any equity as a deposit on a new car

Hire Purchase (HP)

HP is a very simple and flexible way to buy a car as long as you make a down payment and the fixed monthly installments are paid. The car then becomes yours after the full payment.

Personal Contract Hire (PCH)

PCH would be more of a long-term rental arrangement. You do not own the car, but you can use it for a particular time, which would usually be reflected as lower monthly payments compared to other finance methods.

Personal Loan

With a personal loan, you obtain the amount of the car from a bank or lender and consequently, buy it directly from the money you get, while you pay back the loan in monthly increments.

Car Insurance for Financed Cars

One of the most important things to consider while buying a car on finance is the issue of insurance, which most often is a requirement of the financial lender. The lender will need to know that you have insurance that is practically for all damages that might take place apart from you being a victim of a crash or theft, and thus your car gets its compensation when necessary.

The following are the most critical points concerning car insurance for financed cars:

-

- Comprehensive coverage is typically required

-

- Some finance agreements will add gap insurance to cover any deficiency between the car’s value and the amount owed on finance

-

- There might be some finance agreements which include insurance as part of the package

No Credit Check Car Finance

Buying or leasing a car when your credit history does not meet the beneficial criteria is difficult. However, a lot of lenders have developed the ‘no credit check’ car finance solutions lately. These practices have their own pros and cons that people should be aware of. They include the following:

Pros of No Credit Check Car Finance:

-

- Persons who have either no credit history or bad credit are now able to get financing

-

- The process of approval is instant

-

- It’s a chance to lift one’s credit score when regularly paying back the finance

Cons of No Credit Check Car Finance:

-

- Interest rates are relatively high

-

- You might have to select from a limited model variety

-

- There is the risk of being a victim of unfair practices with some lenders

It’s important to note that they are actually similar in their essence even though ‘no credit score car finance’ and ‘car finance without credit check’ are different terms that signify diverse ways of providing an alternative for clients who are having a hard time to get the ordinary options of credit.

Car Finance Unit Stocking

Car unit financing is a common term people in the automotive industry use to describe the practice of dealership inventory and stocking. From the customer’s perspective, you do not have to directly deal with the concept as it is the dealerships that benefit from it, but it may still have an impact on the cars that are available, and thus, the deals you get.

Car Finance Claim Calculator

A calculator designed for car finance claims is an outstanding tool that helps one to approximate monthly installments based on the variables of:

-

- Car cost

-

- Down payment amount

-

- Interest rate

-

- Loan repayment term

Lots of online tools are available to assist you in effective resource planning.

Negative Equity Car Finance

In case you owe more on your car than it is worth, you are trapped in a situation called negative equity. This can occur for instance during depreciation at a rapid rate or if you are engaged in a long-term finance agreement. Your debts can even be included in a new deal with a service provider, but it is strongly recommended that you be very cautious when choosing this because in most cases it can bring about higher costs.

Mis-sold Car Finance Calculator

If you are convinced that you have been mis-sold a car that has been financed, a mis-sold car finance calculator can help you find out whether you are eligible for compensation. These are typically facing the following structure:

-

- The type of finance agreement

-

- When it was taken out

-

- The interest rate applied

-

- Any additional costs or charges

Car Finance in Birmingham

Contrary to the general approach to car financing, one should keep in mind that different places offer different, sometimes better, deals. That is, for instance, car finance in Birmingham may have certain kinds of bargains or dealers that are not found in other places. Always be informed of the local options when picking car finance.

Car Finance for Students

The option of car finance is limited as an adolescent due low income and credit deficiency which could be a student’s stumbling block. Nevertheless, there are some lenders that have plans that are specifically tailored for learners. They may include the following:

-

- Less money upfront

-

- Flexibility in repaying the loan

-

- Consideration for your future earning potential

CCJ Car Finance

If a court case has been given a judgment that leads to negative financial implications, this will definitely affect your eligibility for any service, including ‘car finance’. However, few suppliers are specialized in connection to CCJ car finance; they might offer higher interest but at least can be a pathway to car ownership for people who have had financial instability.

Instant Car Finance

In the contemporary world, many financial institutions are racing to come up with products that ensure potential clients receive immediate credit responses and can thus quickly purchase cars. Despite being a major convenience, ‘instant’ doesn’t always translate to ‘best’. Be sure to examine and understand the terms before finally settling for what you might regret later on.

Key Considerations When Choosing Car Finance

When you think about getting a car on finance, it is crucial to consider what comes next:

-

- Total cost of finance (including interest and expenses)

-

- Monthly payment amount

-

- Length of the finance term

-

- Your credit score and history

-

- The car’s depreciation rate

-

- Early repayment opportunities and penalties

Tips for Getting the Best Car Finance Deal

Based on my many years of experience in this industry, the following are some tips that will help you find the best car finance solutions for you:

-

- Do a quick credit check to verify if there are any errors before putting in your application

-

- If achievable, give as much as you can as a deposit when you apply for a loan

-

- Of the offers you get, make a comparison to see which one best suits your needs

-

- Requesting a pre-approval might help you get better rates from the bank, which lets you be in a more solid bargaining position

-

- Steer clear of offers that are too good to be true

-

- Examine the terms and conditions very well

-

- Listen to your instincts if something doesn’t appear right

The Future of Car Finance

The car finance industry remains in a continuous flux, and some of the future highlights might be the following:

-

- AI technology could become widely used in determining loan rentability

-

- It is predicted that a sales revolution will consist of e-commerce and whichever other similar mode in time to come

-

- The range of finance services is likely to be extended in order to meet the preferences of different clients

-

- Increasing focus on electric and sustainable car finance.

Common Car Finance Terms

An illustrative table of a few customary terms that you may come across in discussions about car finance will help you fare through these talks:

| Term | Definition |

|---|---|

| APR | Annual Percentage Rate is the yearly interest rate on your finance |

| Balloon Payment | It refers to a large final payout at the end of a PCP contract |

| Credit Score | This phrase stands for a numerical indicator of your borrowing soundness |

| Depreciation | It is the term used to describe the decline of a car’s value over time |

| Equity | Equity is the difference between the value of your car and the amount owed on it to the lender. |

| Guaranteed Minimum Future Value (GMFV) | It is the lowest value at which your car would be sold under a PCP agreement |

Conclusion

The discussion of car finance can usually be a bit complex, but if handled as I have suggested here there can be no troublesome issues. Know that no financial situation is the same as the other, so what was perfect for one person might not be the ideal choice for you. Do not rush your decisions. Carefully read the contract terms, and do not hesitate to ask for clarification. Make a good choice and your future will be full of the best things.

One of the things I have never stopped doing is organizing car finance for people; it is not a treasure hunt but it is a way to acquire a car you wish for. All you have to do is to be patient and keep yourself informed so that after some time you may find the car finance plan that is within your budget and satisfies your needs. There is a car finance option for everyone, so to speak. You may be a student seeking to start, a person having a low credit score, or simply exploring the available car finance solutions.

Leave a Comment