With the global economic markets going digital, personal financial management has emerged as a highly prioritized aspect today. I am thrilled to bring you this year as a game changer: my money.app banking. This pioneering technology is designed to pave the way for a new era where users can have their financial issues in a more straightforward manner through a series of applications and features.

What is My-Money.App Banking?

My-money.app banking is a new fangled online money management platform that mixes the functionality of a normal bank with tools meant for the managing of capital and payments in the digital age. Its purpose is to be a single, problem-free solution for a banking service. As a person who has been deeply involved in the trend of fintech I can say without a try that this app is an indicator of progress in the field of personal finance technology.

Key Features of My Money.App Banking

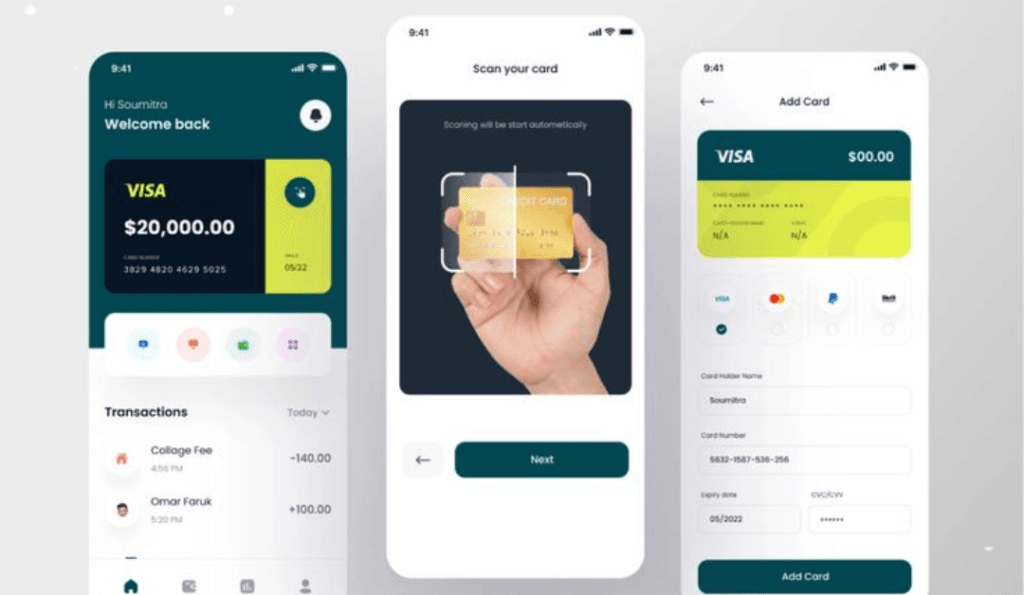

1. Intuitive User Interface

The program is known for its ease of use on my-money.app banking. A simple and modern interface allows users of all ages and technical abilities to quickly access the information they are looking for. Whether you are a digital native or you are just getting started with online banking, you will like the app’s simple and logical structure.

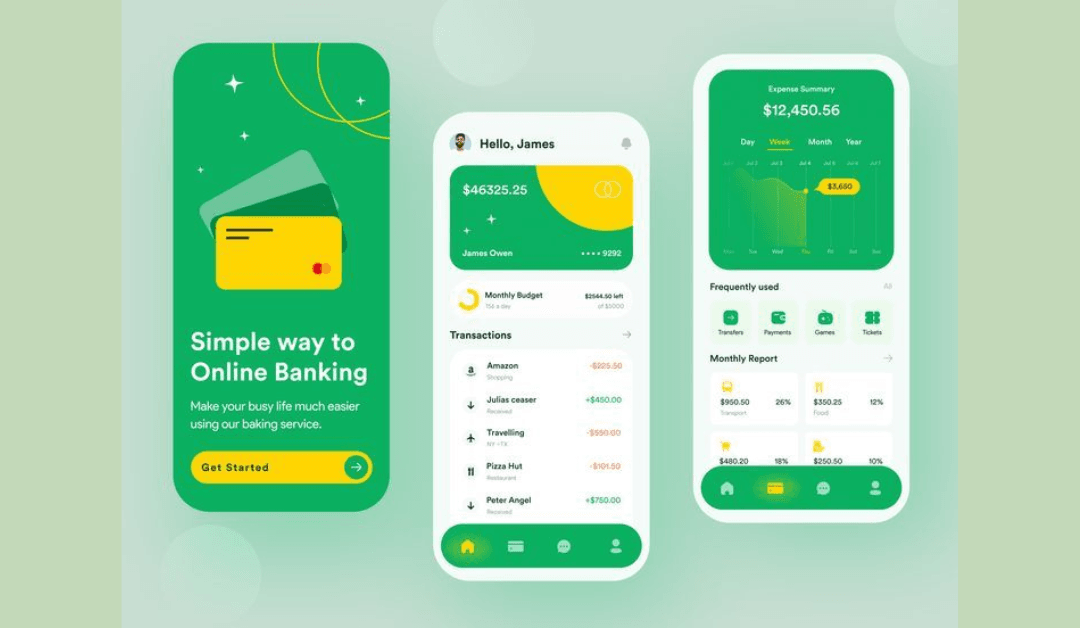

2. Comprehensive Account Management

By means of my-money.app banking the users are provided with an environment for easy control of their bank accounts, which may be of checking accounts, savings accounts, and investment portfolios. With the statement of all your financial information that can be viewed at a glance, the need to know one’s own financial health is addressed.

3. Advanced Budgeting Tools

The app consists of smart budgeting capabilities to assist people to be proactive at their spending, goal setting, and setting up unique family plans. These utilities, through the use of age-intelligent guesses, track/explore purchases and make recommendations for customizing savings strategies.

4. Real-Time Transaction Tracking

My-money.app banking is keen at sending texts instantly after conducting transactions so that all users can control their incomes and turn them into the fittest results. This feature is also practical in pointing out possible fraud and maintaining correct records of the money spent.

5. Bill Payment and Reminders

The app manages the payment of bills by making automatic bill payments plus timely reminders. This is a great way to avoid missing payments and increase credit score because late fees are not incurred.

6. Investment Management

my-money.app banking is the perfect platform for those who want to make their money work for them. Investment management tools form the part of the many interesting things for users. This way users can follow up on their investments, get insights into the market and even make trades directly through the app.

Security: A Top Priority

In the online era, data security is a big issue, especially in cases of financial apps. The security practice of my-money.app banking is such that it is security-wise advanced and can keep the safe of transactional data and user data private. These features are:

-

- End-to-end encryption of all data communication

-

- Biometric authentication options (fingerprint and facial recognition)

-

- Two-factor authentication for additional security

-

- Regular security checks and updates

The Benefits of Using My-Money.App Banking

1. Time-Saving

Bringing all financial operations together in a single application, my-money.app banking makes it a snap to keep a bird’s eye view of everything you do and hence saves a lot of time. No need to have many apps or websites to get all different phases of your life under control.

2. Improved Financial Awareness

Through a brief analysis of your personal economy, the tool informs you about the normal limitations in your habit of spending, the amount of money you save, and the accounts you invest in. This newly won awareness could help you make more financially responsible choices.

3. Goal-Oriented Savings

By setting and monitoring your goals, you are at liberty to be more specific with your savings. The application is a good one-stop-shop for your saving needs, whether it is intended for a trip, a new house, or retirement, it will provide you the tools to keep you on the right path and achieve your goal.

4. Personalized Financial Advice

The app, using AI and machine learning, is adept at delivering financial advice that is tailor-made for you because it will consider all of your financial parameters including the goals you have set. This step-by-step advice can assist you in taking critical decisions that are backed by information.

5. Seamless Integration with Other Financial Services

My-money.app banking has a deal with other financial services and it merges well with them which accords for a more global outline of money management.

Looking Ahead: The Future of Personal Banking

During the rest of this year, my-money.app banking will be especially important in the process of developing the future of finance. The app developers have been working on a set of new features and improvements, such as:

-

- Enhanced AI features for the precise prediction of financial variables

-

- Linkup with cryptocurrency platforms for additive interested in the digital assets

-

- Extended financial education resources to aid users in enhancing their financial knowledge

-

- Intensified security precautions to the greatest extent

Getting Started with My-Money.App Banking

If you want to use my-money.app banking, the step-by-step process is smooth and simple. The software is available for both iOS and Android operating system devices. Once it’s downloaded, you will be asked to create an account and do the identity check. After setting up, you can associate existing bank accounts and begin to explore the app’s features.

Concluding

my-money.app banking is a great achievement in personal finance management. By using both traditional banking systems and edgy technologies in addition to a good design that fits the user, it gives a complete way to manage your financials for 2024 and even beyond. Just in case of wanting to make a fancy budgeting, to grow your investments, or simply take a grip on your financial situation, my-money.app banking will make that possible for you with its tools and information.

More Info Click Here

Leave a Comment