Understanding Negative Equity Car Loans: A Comprehensive Guide

Having been a financial advisor in the automotive industry for many years, I had the chance to deal with numerous cases like how people are caught in negative equity car loans. Within the comprehensive guide I present, I will be sharing my insights and professional advice with you in order for you to know the meaning of negative equity, its consequences, and the suitable techniques for mitigating this challenging financial situation.

What Does Negative Equity Mean in a Car Loan?

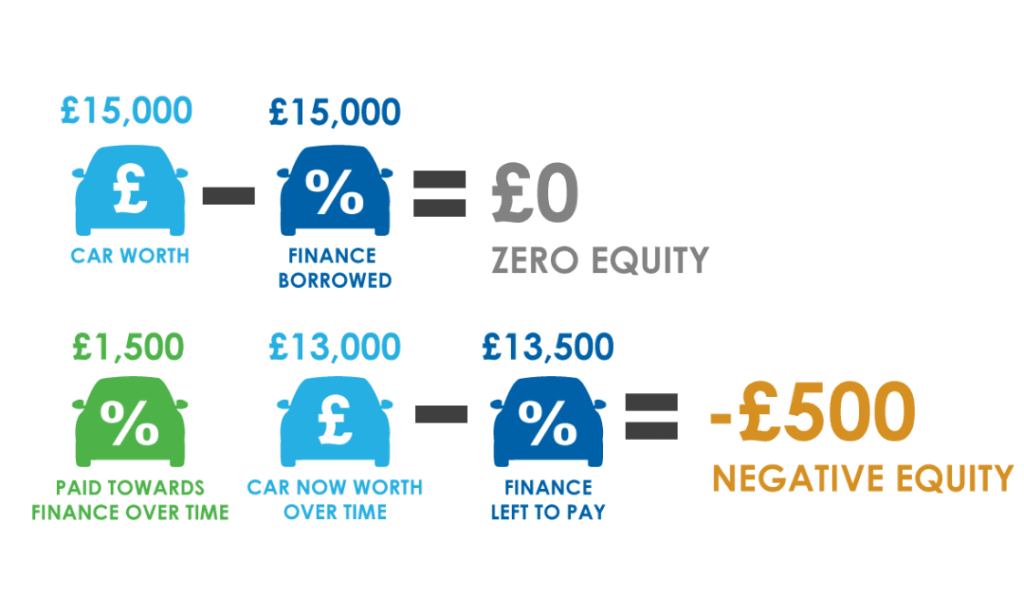

When you are “upside down” or “underwater” on a car loan, which is often referred to as negative equity, it means that you owe more than the vehicle is worth. This occurs due to several factors:

-

- The vehicle having high rates of depreciation

-

- High-interest rates on the loan

-

- Lengthy loan terms

-

- Little or no down payment

-

- Rolling over negative equity from the previous car loan

For example, consider this: I owe $20,000 from a $15,000 car loan, whilst the car’s current market value remains the same, I possess a $5,000 negative equity.

The Impact of Negative Equity on Your Finances

When you have a deficiency of equity in your car loan, there are several serious implications that you may encounter:

-

- The vehicle can be very hard to sell or trade in

-

- You may have higher monthly payments

-

- There would be an increase in the overall cost of vehicle ownership

-

- It becomes very difficult to refinance

-

- Possibility of experiencing financial stress

How to Get Out of Negative Equity Car Finance

If you are in a negative equity situation, then you have various strategies to choose from to improve your financial standing:

1. Continue Making Payments

One of the simple ways to deal with negative equity is to just continue paying the car loan each month as one does. The reduction of the principal over time and the slowing down of the vehicle’s depreciation can eventually let you get some positive equity.

2. Make Extra Payments

When your budget permits, extra payments toward the principal will shorten the length of equity creation which will help you gain it quicker. Even minor contributions can make a significant difference in the long run.

3. Refinance Your Loan

There are times when you might consider refinancing your car loan for a reduction in the interest rate or an elongation of the loan term which will ultimately decrease your monthly payments. Please be aware of the fact that extending the loan term is a potential negative if more interest is paid over time.

4. Sell the Vehicle Privately

Selling a car on your own is a typical way to obtain more money than trading it in. Using that money to pay off debt can be an approach to lessen the gap between the amount you owe and the car’s value. Especially if you traded in the vehicle, you may need to pay off the balance. However, the amount you need to come up with might be lower than if you traded in the car.

5. Consider Voluntary Surrender

If all else fails, you may consider voluntarily surrendering the vehicle to the lending company. Date the fact that it will damage your credit score but it is sometimes a better choice then having the car taken away from you.

Negative Equity Car Loan Interest Rates

Interest rates have a key role in negative equity challenges. Higher interest rates can introduce the problem of increased costs, thus the overall cost of the loan will go up. Here’s a brief overview of how interest rates can affect negative equity:

| Interest Rate | Loan Term | Loan Amount | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|

| 5% | 60 months | $25,000 | $471.78 | $3,307.18 |

| 10% | 60 months | $25,000 | $531.18 | $6,870.89 |

| 15% | 60 months | $25,000 | $594.53 | $10,671.72 |

Not surprisingly, higher interest rates result in the total interest paid throughout the loan life, thus it may become difficult for equity to be built.

Negative Equity Car Loan Calculator

So as to find out if you are in the negative equity case and determine the exact sum of it you can use a negative equity car loan calculator. These tools usually require the provision of some basic data:

-

- Present loan remains

-

- Car’s present market value

-

- Interest rate

-

- Balance of the loan remaining

By using the above-mentioned info, you can acquire a precise position of your equity and delve into the possibilities of enhancing your situation.

Negative Equity Finance Options

Concerning negative equity, it is worth mentioning several financing options like the following:

1. Gap Insurance

Gap insurance is an indirect method to alleviate the negative effects of negative equity. It ensures that you are paid the difference between the car’s value and the outstanding loan if the vehicle is stolen or totaled.

2. Rolling Over Negative Equity

There may be some lenders who are interested in assisting you by letting you “roll” your negative equity into a new auto loan. However, this version should be examined carefully as ti may lead to a larger sum of money borrowed and thus a greater negative equity to deal with.

3. Personal Loans

One way you might be able to take out some of your negative equity using a personal loan, especially if you can get a lower interest rate than your current car loan.

4. Home Equity Loans or Lines of Credit

If some of your home’s equity is available, then you could feasibly use home equity lines of credit or home equity loans. There is a greate rlevel of risk since if you are not able to pay the borrowed amounts you will lose your home.

Negative Equity Car Loan with Bad Credit

It can be a daunting process to gain a car loan when you are in a negative equity position and have a bad credit history. Lenders will perceive you as a risky investment and might charge you more, refuse your application, or both. Employ the suggestions herein:

-

- Repairing your credit history before getting a new loan can bring better results

-

- To cover the negative equity, a larger down payment will be O.K.

-

- Another alternative is to have a co-signer with a positive credit rating

-

- Check out subprime loans, but avoid aggressive practices

-

- Credit unions may be an alternative because they might give you lower interest rates

Understanding Negative Equity Loans

Negative equity loan is not a specific type of the loan, rather it is a situation when the amount borrowed is above the market price of the object being loaned. The principle of negative equity is applicable not only in the context of car loans, but also in secured loans from other sources like mortgages.

Basic features to know about negative equity loans contain:

-

- They can complicate the sale or refinancing procedure of the asset

-

- Additional collateral might be needed or a higher interest rate might be presented for these loans

-

- This might be a situation that will last long if proper management strategies are not in place

Negative Equity Finance Calculator

A negative equity finance calculator is critically valuable for becoming aware of your current financial situation and finding different ways of dealing with it. Here are the things to do with these calculators:

-

- Compute your current equity position

-

- Estimate how long it will take to get positive equity

-

- Look into various compromises of loan terms and interest rates

-

- See how the application of extra payments will influence your equity standing

Do not forget that the results offered by these calculators are only approximations based on the input you have furnished. So, confer with a specialist for valid valuations.

Negative Equity: A Deeper Understanding

The complete picture of negative equity covers not only the theoretical level but also the relationship to the aspects of personal finance and the reasons behind it:

Depreciation and Negative Equity

Automobile depreciation is a significant element responsible for negative equity. New cars may lose up to 20% of their original value in the first year of ownership. This fast depreciation can quickly outstrip loan repayment, leading to the formation of negative equity.

The Role of Down Payments

A significant down payment can function as a shield from negative equity by starting off the loan with less money borrowed. My advice is to advise my clients to strive for at least 20% down payments for cars that they are purchasing.

Loan Terms and Negative Equity

Although the payment amounts are admittedly lower with longer loan terms, negative equity can still occur at an increased rate. This is because of the relationship between the vehicle’s loss of value and the repayment of the loan during the earliest years of the purchase.

The Impact on Credit Scores

While negative equity does not directly affect your credit score, it indirectly can if you aren’t timely with your loan payments, etc.

Strategies to Avoid Negative Equity

Based on my experience, the following are some strategies that you can use to steer clear of negative equity situations:

-

- Choose a vehicle that is less prone to depreciation

-

- Give a substantial down payment

-

- Opt for shorter loan terms

-

- Avoid negative equity roll-over from the previous loan

-

- Decide on leasing a car rather than purchasing it if you like to change vehicles often

The Psychological Impact of Negative Equity

One should not ignore the mental distress that comes with being in negative equity. I have spoken to quite a few clients who have found it to be an incredibly stressful and difficult experience for them. Remember that negative equity is a financial problem that can be addressed and resolved with the proper strategies and outlook.

Conclusion

Although a negative equity car loan can be quite a hard financial issue to handle, it is not something that is impossible to deal with. By grasping the concept of negative equity involving negative equity and understanding the other elements that cause its existence, as well as being aware of the diversity of strategies to treat with it, you can be an educated customer. Just remember that each financial situation is different and what works for one can possibly not be a good solution for another vehicle buyer.

Leave a Comment